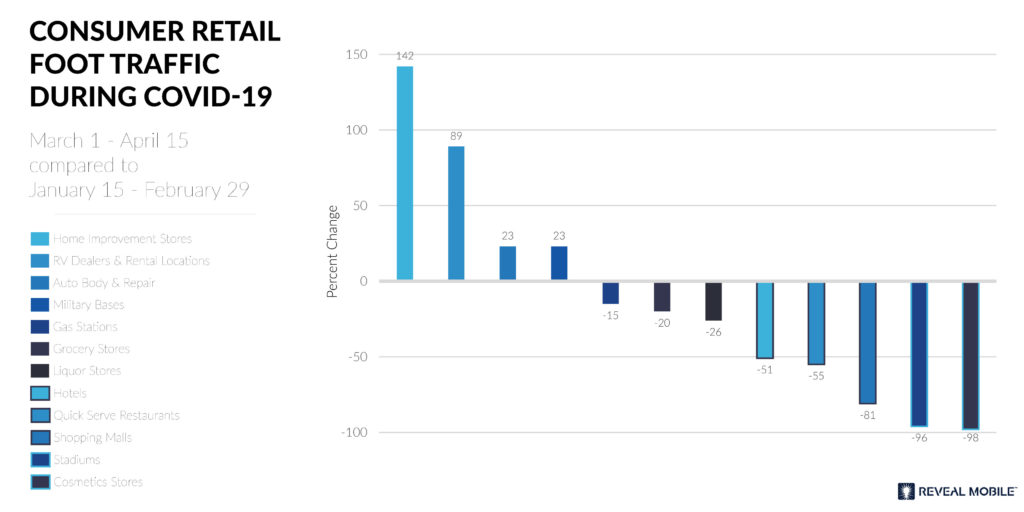

Consumer Retail Foot Traffic During COVID-19

May 5, 2020 by

Here at Reveal Mobile, we collect privacy-compliant location data from mobile phones and match it to our proprietary point-of-interest database of more than 12 million businesses. This aggregated GPS data is normally put to work powering custom audiences for digital ad campaigns and solving for foot traffic attribution. In the current climate, we want to share what foot traffic trends tell us about various consumer and retail categories. We all know foot traffic to most businesses and other public places has dropped since March 1. But there are a number of locations where foot traffic volumes have gone up considerably. Some of the biggest foot traffic gainers and losers may surprise you. Let’s dive in and see what story the data has to tell.

Consumer categories with the largest increase in foot traffic

The biggest foot traffic gainer over most of the COVID-19 outbreak has been the home improvement and hardware store categories. This may come as no surprise as it is one of the few essential businesses that has remained open throughout this time. The category’s foot traffic between March 1 and April 15 increased 142 percent compared to the previous 45 days (Jan. 15 through Feb. 29).

CNBC reported that Lowe’s has seen an increase across nearly every store category as customers stock up on cleaning supplies and work on home projects. Lowe’s CEO Marvin Ellison said the increase stems from “customers… looking at that deferred list of home projects. As they spend time around the home, they now have more time on their hands to tackle some of those things.” The increase in foot traffic may also be tied to the time of year. Customers may not only be “buying appliances and doing home projects as they hunker down at home”, as CNBC reported, they are likely also buying shrubs, flowers and mulch to refurbish their landscaping.

The category that saw the second largest lift in foot traffic is RV dealerships and rental locations. The increase reveals an unexpected trend during the quarantine period. The LA Times reported, “even in a time of travel restrictions, national RV companies are also still getting some traditional bookings — mostly from people with urgent travel needs.” Those who can’t fly are driving. If the friends or family travelers are visiting practice social distancing and hotels are closed, the RV does double duty and serves as a place to stay at the travelers’ destination. Those with a taste for adventure and more time on their hands are also enjoying traveling around in their RV, the LA Times article explains.

Another reason visits to RV sales and rental locations may be up is healthcare workers are choosing to self-isolate from their families. Many are turning to RVs so they can stay on their property and close to family members, but at a safe distance. The demand for RVs is significant, but those who do not have the means to rent or buy can borrow. CBS recently ran a story about a Facebook group that brings RV owners and self-isolating healthcare workers together.

We found that auto repair and auto body shops have seen a 23 percent increase in foot traffic between March 1 and April 15. This may be because more people are working from home, or unfortunately not working at all, and now find themselves with a more flexible schedule to finally get the repairs done they have been putting off. It is also a category of essential businesses that are often independently owned. Many patrons are looking to support local businesses, and auto repair shops provide a good option to do this.

Reveal Mobile’s location data tells us that foot traffic to military bases has increased by 23 percent as well. While this is not considered a consumer category, it is noteworthy. The increase correlates with stories in the news about international travelers and cruise ship vacationers quarantining at military bases for 14 days after arriving back in the U.S.

Consumer categories with the biggest drop in foot traffic

As can be expected, there are categories where foot traffic has fallen off considerably. Airports, stadiums, movie theaters, convention centers and shopping malls have either scaled back operations or shut down completely due to state orders.

In this same category, cosmetics stores experienced a 98 percent drop in foot traffic from March 1 through April 15 compared to the previous 45 days. This is largely due to these retailers closing their doors. The elimination of foot traffic to cosmetic brands’ stores, however, has not translated to a commensurate decline in sales. One notable example, according to Cosmetics Business, is the direct-selling beauty brand Monat reporting a 22 percent boost in sales over the past month; particularly in the brand’s self-care category. Larger beauty brands tend to have a strong online presence, robust ecommerce logistics and loyal customers have their go-to products established, which makes for a smooth transition to generating sales exclusively online.

Similar to the reasons why foot traffic to airports fell significantly, foot traffic to hotels and other lodging facilities dropped by 51 percent for the period. The travel and hospitality industry has been one of the hardest hit by the COVID-19 outbreak. Though the foot traffic in this category has decreased by half, it likely didn’t drop by more because of two reasons. First, healthcare workers, especially in the most affected cities, are self-quarantining to protect their families and loved ones from the risk of exposure. Second, the homeless population of many cities is occupying otherwise vacant hotel rooms to comply with social distancing guidelines and prevent outbreaks at crowded homeless shelters. (A 2017 study shows that 94 percent of homeless adults have a cell phone.)

The two retail categories where a drop in foot traffic comes as a surprise are liquor stores and grocery stores, two essential businesses that have handled much of the panic buying. Foot traffic to liquor stores and grocery stores for the period dropped by 26 percent and 20 percent, respectively. Nevertheless, sales are up in both categories.

Americans are drinking a lot of alcohol during the pandemic. According to research conducted by Neilsen, as reported by Newsweek, “in the week ending March 21, sales on alcoholic beverages have spiked by 55 percent.” Sales of spirits alone increased by 75 percent. Beer sales are up 66 percent, and wine sales have increased by 44 percent compared to the same period in 2019.

Grocery store sales have also increased. Supermarket News reported that Kroger saw a “30 percent surge in identical-store sales for March.” Similarly, Publix reported a $1 Billion increase in Q1 sales due to the pandemic.

If liquor and grocery sales are up, why is foot traffic down? Two likely reasons.

First, consumer behaviors have materially changed. Customers are visiting these categories less frequently and spending more during each trip. Leaving the house and exposing oneself to the risk of contracting the virus is adding stress to errands that used to be simple, even enjoyable. Because of this stress, people are going out far less frequently, so they are stocking up every time they leave. Some people may have visited the grocery store several times per week, but now their visits are more spread out as they try to limit their potential exposure.

First, consumer behaviors have materially changed. Customers are visiting these categories less frequently and spending more during each trip. Leaving the house and exposing oneself to the risk of contracting the virus is adding stress to errands that used to be simple, even enjoyable. Because of this stress, people are going out far less frequently, so they are stocking up every time they leave. Some people may have visited the grocery store several times per week, but now their visits are more spread out as they try to limit their potential exposure.

Second, because of the risk of exposure and stress that is induced by going to grocery stores, liquor stores and the like, fewer people may be shopping at a time. Individuals may be going out alone rather than in groups like they may have before. The population most at risk, the elderly and immunocompromised, are avoiding public places altogether and turning to loved ones to go for them or relying on delivery.

While the COVID-19 pandemic is showing a few early signs of abating in select portions of the U.S., stores and other public locations are exercising caution when it comes to reopening or restarting normal operations. Foot traffic will continue to be unpredictable during this next phase, and we will continue to share valuable insights.

If you have any questions about the store visit data in the post, please contact us.