Are Major League Sports Sponsorships Worth It?

October 8, 2020 by

Sports fans all across the U.S. were heartbroken when their teams were forced to end their seasons prematurely in March 2020 due to the COVID-19 pandemic. The two major U.S. sports leagues that normally play in March, the NBA and NHL, cut short their seasons. On top of that disruption, Major League Baseball delayed their opening games.

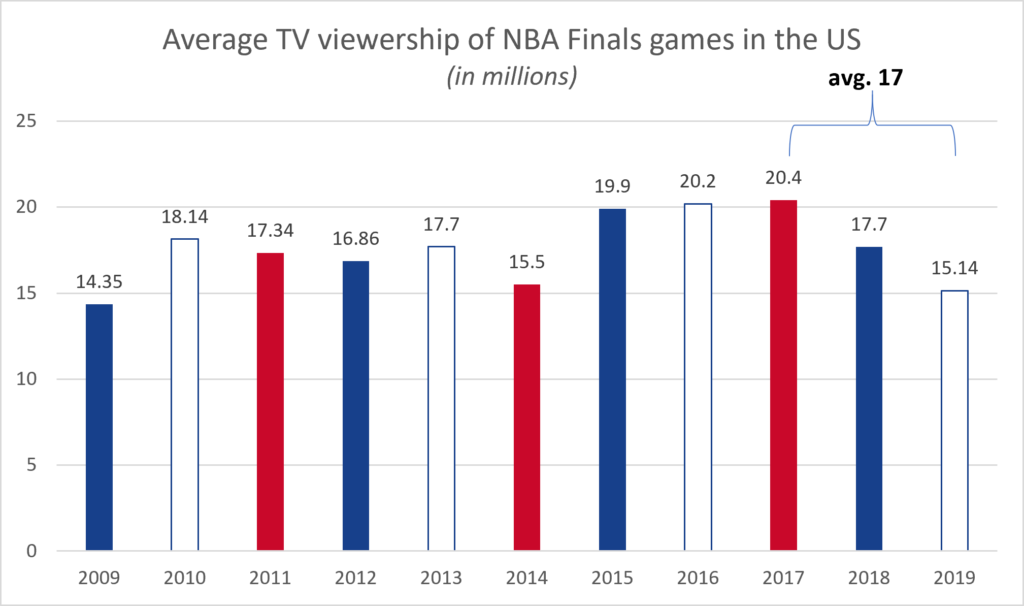

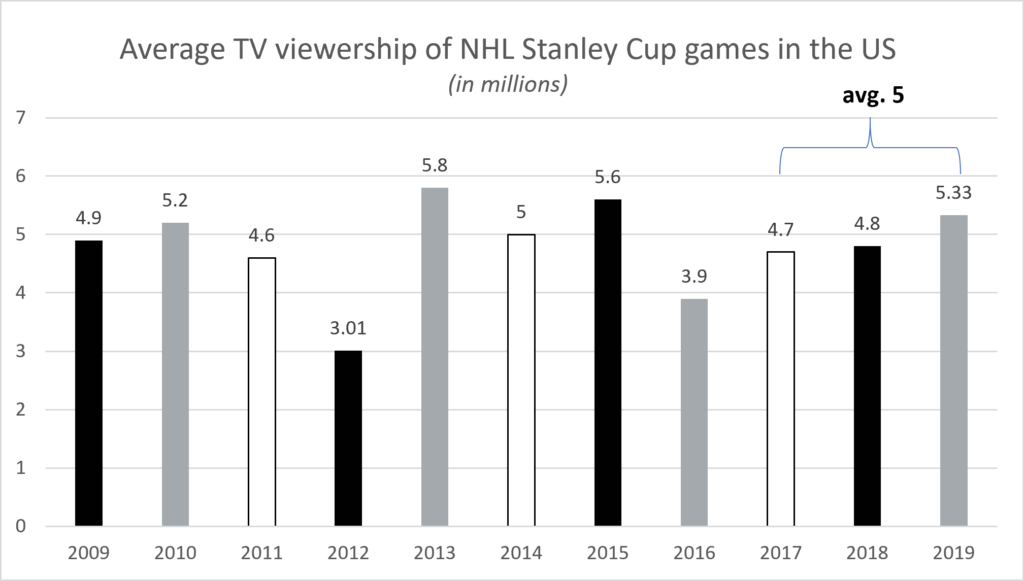

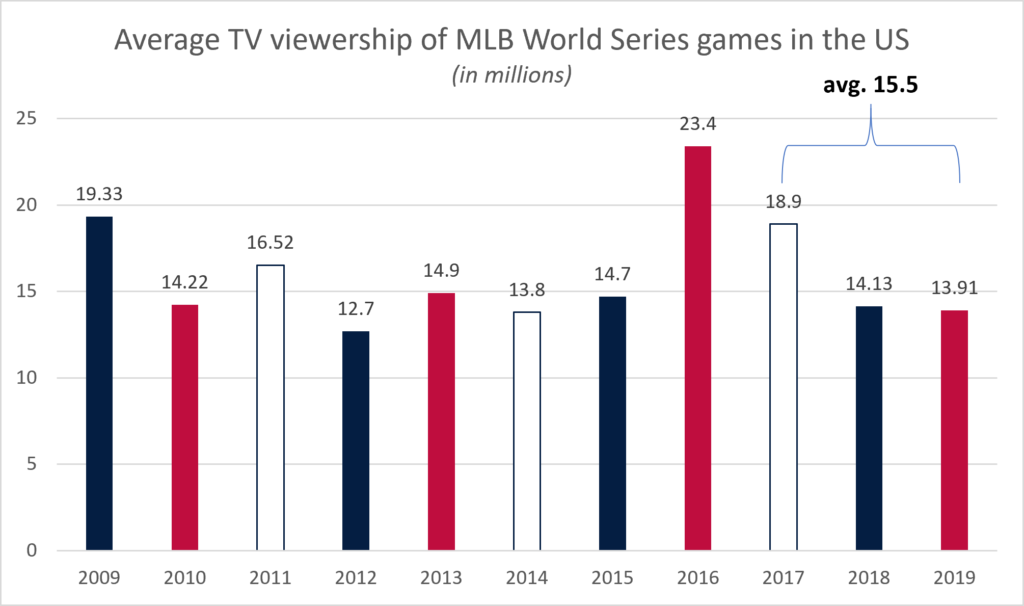

The number of fans affected was unprecedented. The NBA Finals has garnered more than 17 million viewers on average over the past three years. The NHL Stanley Cup Finals had 5 million viewers each year for the past three years, and the World Series has drawn 15 and a half million viewers in the same timeframe.

That’s not only a lot of fans missing out on games, but a lot of potential customers the sponsors of each league were not able to capture by running their ads during games.

Source of data: Statista

Source of data: Statista

Source of data: Statista

These shutdowns not only disappointed fans but shuttered merchants, service providers and sub-sectors of the economy as well. The U.S. sports market sector amounts to $31.8 billion, including everything from live sporting events to food stands to media sponsorships to material goods. Breaking this down further, MLB is worth $10.7 billion; the NBA is worth $8 billion, and the NHL is worth $5.1 billion.

As large as major league sports are — and their commensurate impact on consumer perceptions and behaviors, advertising budgets shifted due to the pandemic. While dollars designed to activate shoppers stalled, big league sponsorship dollars have not.

That raised a question: How has foot traffic to official sponsor brands changed as a result of major league games restarting? Do major league sponsorships drive brand awareness and foot traffic? Or just awareness?

We looked at foot traffic to the major sponsors that have physical locations for the month before the league restarted games and compared it to foot traffic in the first month the leagues were back in action. Reveal Mobile’s foot traffic data shows the impact sponsorships have had on MLB, NBA and NHL sponsors’ brick and mortar stores.

The Sponsors

MLB

We analyzed the foot traffic to the following MLB sponsors with physical locations:

- Camping World

- Chevrolet

- Super Cuts

- Taco Bell

- Good Sam member RV parks

- T Mobile

NHL

We analyzed the foot traffic to the following NHL sponsors with physical locations:

NBA

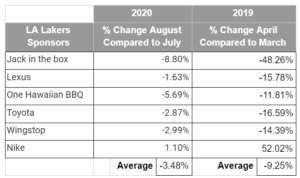

In the NBA, brands sponsor teams rather than the league as a whole. So we took a look at the following Los Angeles Lakers sponsors with physical locations in the Los Angeles greater area:

MLB Sponsors Foot Traffic

Looking at the month before the MLB season restarted compared to the first month back on the field, you can see T Mobile and Super Cuts saw an uptick in foot traffic to their locations, while several other sponsors saw a reduction in foot traffic. While Taco Bell, Camping World, Chevy dealerships and Good Sam saw a drop in visits, their sponsorship may have mitigated the loss they would have seen had they not generated awareness during the month of August. Their foot traffic may have fallen even more if it were not for their increase of mindshare while running ads and having their banners up during games.

During a typical year, MLB sponsors tend to see a sizable jump in foot traffic to their locations after the commencement of the season. Looking at the 2019 column in the chart above, sponsors see a 23% lift in visits compared to visits during the month prior to the start of the season.

The typical lift likely has to do with the partnership the MLB creates with its advertisers, which is designed to make an impact at the regional and local levels as well as the national level.

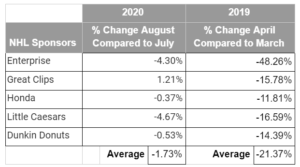

NHL Sponsors Foot Traffic

During a typical year, NHL sponsors don’t see a lift in foot traffic as a result of their sponsorships. In general, these sponsors advertise and engage hockey audiences to increase brand awareness. In 2019, the sponsors saw a 21% drop in foot traffic to their store locations. 2020 foot traffic, however, tells a different story. Most NHL sponsors saw virtually no change in foot traffic to their locations, which points to more successful advertising campaigns this year and the possibility that consumers wanted to show more support for brands they like in the year of the pandemic.

One brand sponsor that saw a much smaller foot traffic drop in 2020 compared to 2019 was Dunkin Donuts. At the beginning of the NHL season in 2019, Dunkin’s foot traffic fell 14 percent month over month. But at the restart of the 2020 season, foot traffic was flat. This is likely to do with the convenience of the quick-serve style and drive through options the brand offers in their restaurants. During the pandemic, people have been more likely to choose options that offer the least amount of exposure with other people and the lowest prices. This is where Dunkin thrives. Dunkin Donuts describes their COVID-19 changes as “focused on making your experience as frictionless as possible, whether through our 5,300+ drive-thru locations, On-the-Go ordering and curbside pickup through the Dunkin’ app, or delivery through GrubHub and other providers.”

LA Lakers

Similar to the NHL, the LA Lakers’ sponsor brands did not see an increase in foot traffic at the start of the 2019 season. Last year, the sponsors saw an average foot traffic drop of about 9%, but only saw their foot traffic fall by 3.5% at the start of the 2020 season.

Nike sponsors and sells NBA uniforms — all teams, not just the Lakers’ — and sees a regular lift in foot traffic at the start of the season. This is likely because fans want to stock up on their new favorite players’ jerseys and other gear for the new season.

At the beginning of the 2019 basketball season, Nike saw a 52% increase in foot traffic to their stores in the LA area. The restart of the 2020 season followed a similar trend with a 1% foot traffic lift, heavily tempered by COVID-19.

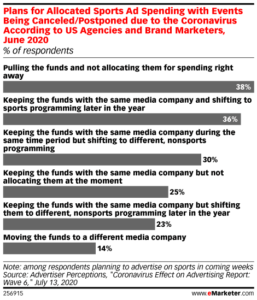

According to an eMarketer report, 38% of U.S. agency and brand marketers decided to pull ad dollars from cancelled and postponed sporting events due to the coronavirus. 36% kept their budgets the same and shifted to sports programming later in the year.

According to an eMarketer report, 38% of U.S. agency and brand marketers decided to pull ad dollars from cancelled and postponed sporting events due to the coronavirus. 36% kept their budgets the same and shifted to sports programming later in the year.

It’s important to note that these dollars are not indicative of major league sponsorship dollars.

What we see is that major brands that held on to their sponsorships were able to mitigate a major loss in foot traffic. While most did not see lift, they largely preserved what they had from last year.

Overall, major sponsors of the National Hockey League and National Basketball Association seem to preserve their mindshare with consumers as well as increase brand awareness. Sponsors of Major League Baseball, in particular, see a direct impact from their investment in the form of increased foot traffic to their physical stores.