Retail Foot Traffic Foretells Which Bed Bath & Beyond Stores May Close

December 4, 2019 by

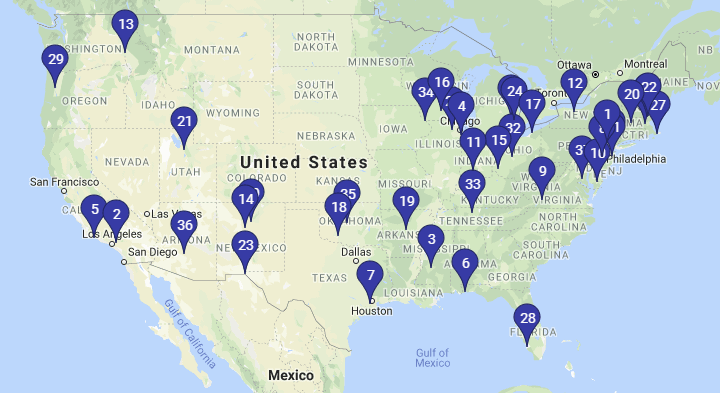

Image source: VISIT Local, software for location-based analytics, audiences and attribution

Image source: VISIT Local, software for location-based analytics, audiences and attribution

According to CNBC, Bed Bath & Beyond lost $137 million in its 2019 fiscal year. It’s the first time the retailer has experienced sub-zero net income since it went public in 1992. To help buoy profits, the company announced in October that it plans to close 40 stores before the end of the year.

Using our location intelligence software, we’re taking a look at in-store foot traffic and making predictions as to which stores will shutter. Foot traffic volume is one of many criteria that could determine the fate of a retail location; store sales, area population growth, and lease end dates are all worth considering as well. We’re using foot traffic as an indicator of what may come, and this is in no way intended to be deterministic.

With 950 stores in the United States, Bed Bath & Beyond established its first retail location in Springfield, NJ. Though that particular store ranks 518th in foot traffic for 2019, we predict it will stay open. The median annual household income of a Springfield, NJ resident is $100,461, about twice the national average. Along with sentimental reasons, individual disposable income makes Springfield an excellent city for a store.

Using Retail Foot Traffic Stats to Predict Store Closings

Keeping our focus on New Jersey, where there are about 40 stores, we predict that the locations in Newton and Howell will be among those that close. The 2019 foot traffic at those locations has been about two percent of the average store’s foot traffic statewide.

What other locations are destined to stay open? Boston, Los Angeles, Washington, D.C., the Bronx and Atlantic City are the five most visited stores across the U.S. In fact, the Boston store, the top location measured by visits, had twice the foot traffic than the Washington, D.C. location and nearly five times more than the Atlantic City store. The Times Square store, a flagship for the brand, sees only 20 percent of the traffic compared to the top Boston spot. It ranks sixth overall.

Ohio may also see a number of store closings. Columbus, Mason and Mentor have stores where foot traffic is among the lowest across the brand.

In other high population states, where the retailer may have overbuilt, store foot traffic is considerably lower than the chain’s national average in Goleta and Glendora, CA, Houston and El Paso, TX, Pensacola and Naples, FL, Calumet City and Geneva, IL, and Rochester and Staten Island, NY. Several of these cities also have multiple Bed Bath & Beyond stores, strengthening the case for consolidation within each metropolitan statistical area.

This brings our prediction count to 15. Based on foot traffic analytics across the retailer’s other locations, here are the 25 stores, in alphabetical order by city, that are likely to close by the end of this year.

- Albuquerque NM

- Bloomington IN

- Chandler AZ

- Christiansburg VA

- Conway AR

- Corvallis, OR

- Dubuque IA

- Evansville IN

- Framingham MA

- Hadley MA

- Hermitage TN

- Hyannis MA

- Jenkintown PA

- Lawton OK

- Madison WI

- Moscow ID

- North Wales PA

- Oklahoma City OK

- Pearl, MS

- Plaistow NH

- Rochester Hills MI

- Roseville MI

- Salem NH

- Salisbury MD

- Sandy UT

- Santa Fe NM

Moving from Bricks to Clicks in Retail

When Bed Bath & Beyond does close 40 of its stores, that consumer dollar is likely to benefit other retailers in the segment. While a share of wallet may go to other brick-and-mortar retailers such as Target, Walmart, JCPenney and Pier 1, much of it will likely move into ecommerce. Retail Dive reports that the home goods retail category is ripe for disruption because of its focus on social media marketing, augmented and virtual reality, and last mile delivery — sales tactics to which consumers respond favorably.