Black Friday Shopping Foot Traffic Trends

June 1, 2022 by

Black Friday Shopping Foot Traffic Trends

To shed light on how the epic shopping day of Black Friday is changing, we’ve pulled together a few of our own statistics, as well as research from a few other companies to show how data can inform advertising spend.

As we mentioned in Street Fight Mag, “We weren’t surprised to see the rush hour of Black Friday foot traffic occur from 11 am–3 pm this year, as we saw similar results from last year. As online and mobile shopping continue to grow, and major retailers continue to shift opening hours with plenty of variance throughout Thursday and Friday, the approach of arriving to your favorite retailer at 5 am for the best deals is quickly becoming old-school.”

Back in 2018, the Wall Street Journal reported: “During Thanksgiving and Black Friday, traffic to U.S. stores fell between 5% and 9% compared with the same days last year, estimated RetailNext, which uses cameras to track people in both mall-based and stand-alone retailers. Another measurement firm, ShopperTrak, estimated traffic fell less sharply, about 1% over the two-day period from a year ago.”

In 2021, the Wall Street Journal reported that foot traffic stayed below pre-pandemic levels despite increases in time and money spent in-store.

CNBC shared data from Sensormatic Solutions that found a 28.3% drop for in-store retail stores in 2021 compared to 2019, reflected by ongoing consumer concerns about supply chain issues and COVID-19. Additionally, online retailers saw $8.9 million in sales in 2021, down from $9 billion in 2020. Together, year-over-year data demonstrate changing consumer attitudes about Black Friday retail shopping and a shift to spreading holiday shopping out throughout the season instead of concentrated on one or two days.

In fact, the National Retail Federation reported 14.1% growth in overall holiday sales from 2020 to 2021, a record high.

The Black Friday statistics here provide a brief insight into holiday retail shopping trends involving online shopping, foot traffic, and in-store purchases. However, remember that the majority of retail shopping still occurs in a physical store. By looking at the retail giants, we can demonstrate these trends in context.

What the Data Shows: Black Friday Retail Patterns

As online and mobile shopping continue to grow, and major retailers continue to shift Black Friday specials earlier in the week and online, the idea of door-busting 6 am specials seems to be more media hype than what consumers are actually adopting.

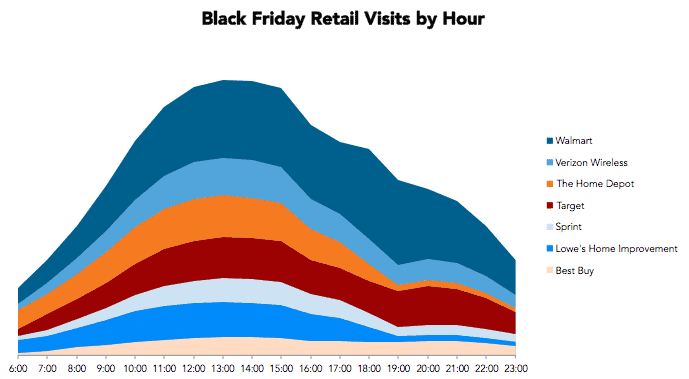

Our research examined the timing of shopping patterns on Black Friday, measured throughout the day at the top seven most visited locations.

Black Friday Retail Foot Traffic

We first looked at foot traffic data from Black Friday. We weren’t surprised to see the rush hour of Black Friday foot traffic occur from 11 am to 3 pm in 2018, as we saw similar results in 2017.

One of the reasons you always see Walmart at the top of these charts is the simple fact that they have double, triple, and quadruple the amount of retail stores. This skews the visitation numbers in their favor but also points to the importance of having a physical retail presence.

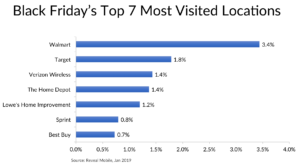

Over the course of Black Friday in 2018, we saw that Walmart received 3.4% of all U.S. retail visits, followed by Target at 1.8%, Verizon Wireless at 1.4%, The Home Depot 1.4%, Lowe’s Home Improvement 1.2%, Spring 0.8%, Best Buy 0.7%.

Holiday Foot Traffic Trends

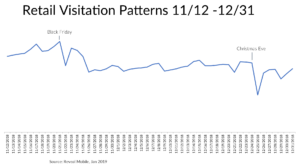

Now as we shift gears towards looking across the entire holiday shopping season, we see that peak retail foot traffic does take place on Black Friday. It spikes on subsequent weekends, but never quite reaches that same level of visitation as it did in November.

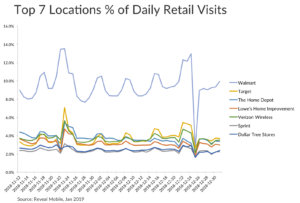

When we look at the trends of retail visitation over the holiday shopping season for just the top seven retailers, Walmart and Target dominate the retail shopping experience. As expected, there is a significant increase in retail foot traffic seen on Black Friday, 11/23/2018, which tapers off very quickly.

Overall shopping increases as the month of December marches on, with a spike in retail shopping on the final weekend before Christmas day. This spike, however, never matches that initial surge from Black Friday. Post-holiday shopping also remains fairly steady, as consumers look to cash in their gift cards, exchange items, and take advantage of post-holiday sales.

Walmart takes the top spot again in 2018 for the highest percentage of overall retail visits during the holidays, with 24.1% of all retail shoppers visiting a Walmart location at least once. These big box, general-purpose retailers command the most market share, with Target seeing 11.3% of all retail traffic. Roughly one out of three retail shoppers, or 35%, visited either a Walmart or Target.

The Home Depot just edges out Lowe’s Home Improvement for their share of holiday retail foot traffic, taking 9.6% of visits. Combined, almost one out of five retail shoppers visited one of these hardware giants during the holidays, or 18%.

Location-Based Marketing for Converting Your Audience

The majority of retail sales still occur at physical locations. Location-based marketing, whether it be geotargeting, geofencing, or geo-conquesting, plays a strategic role for marketers in helping convert their offline shoppers to loyal online shoppers.

Successful marketing of any kind requires knowing your audience, and location-based analytics is one of many great ways to build out that knowledge. Seeing that the early morning hours aren’t the hype they’re made out to be and that retailers offer “Black Friday” discounts well in advance of Black Friday, marketers should adapt their campaigns accordingly.

Walmart’s outsized presence in our report is a testament to the importance of a sizable retail presence but comes with a word of caution. Many retail industry observers note that the United States is over-saturated in retail. As brands sought to scale up quickly, they’ve taken on substantial debt in many cases. When they can’t meet those debt obligations, we see the headlines of store closures and bankruptcies.

Finally, for the thousands of retailers that are not the massive big box stores, they should observe the tactics of what’s working for the major players, then adapt and right-size those methods for their own campaigns.

If you’re interested to learn more about VISIT Local, our location-based analytics and marketing platform, click the button below to see how it works.

The data presented in this study represents aggregated, anonymized, and opted-in U.S based location data.