How Agencies and Brands Use Geofencing Marketing to Grow Their Business

November 9, 2020 by

Updated 5/25/2022

Geofencing marketing has earned its place in the digital marketing mix through the establishment of best practices and consistently driving reliable results.

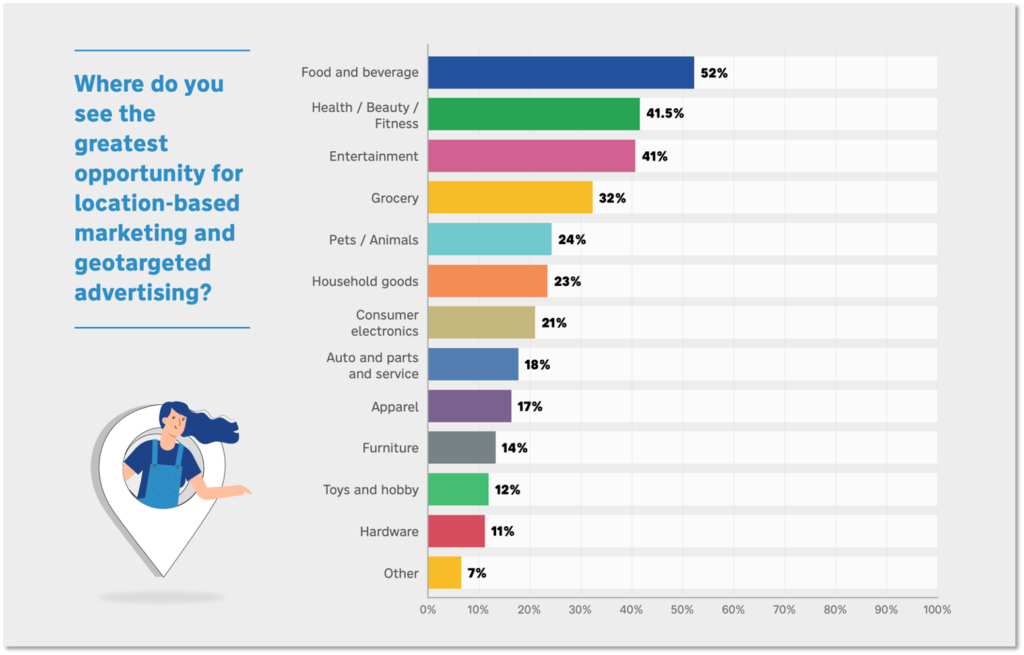

Digital marketers see opportunities for geofencing marketing and geo-targeted advertising in a wide range of industries. When thinking about various retail segments, it’s logical and effective to focus on multi-location units with high foot traffic volumes, such as grocery, restaurants, entertainment, and the like.

Reveal Mobile recently surveyed 116 digital marketers at agencies and brands across the U.S. to provide a clear view of how marketers use location data in marketing and advertising campaigns.

Index

- Industry

- Channel

- KPI

- Call-to-action

- Campaign type

- COVID-19

Geofencing Marketing by Industry

More than 50 percent of marketers surveyed see restaurants and bars as prime locations to target for purposes of driving foot traffic. Health/beauty/fitness, entertainment, grocery, and pet stores round out the top five retail locations for geofencing. However, there are far more places to use in geofencing marketing efforts, many of which go beyond the tried and true. This shows a high degree of ingenuity among marketers who have any number of use cases in mind for geofencing marketing.

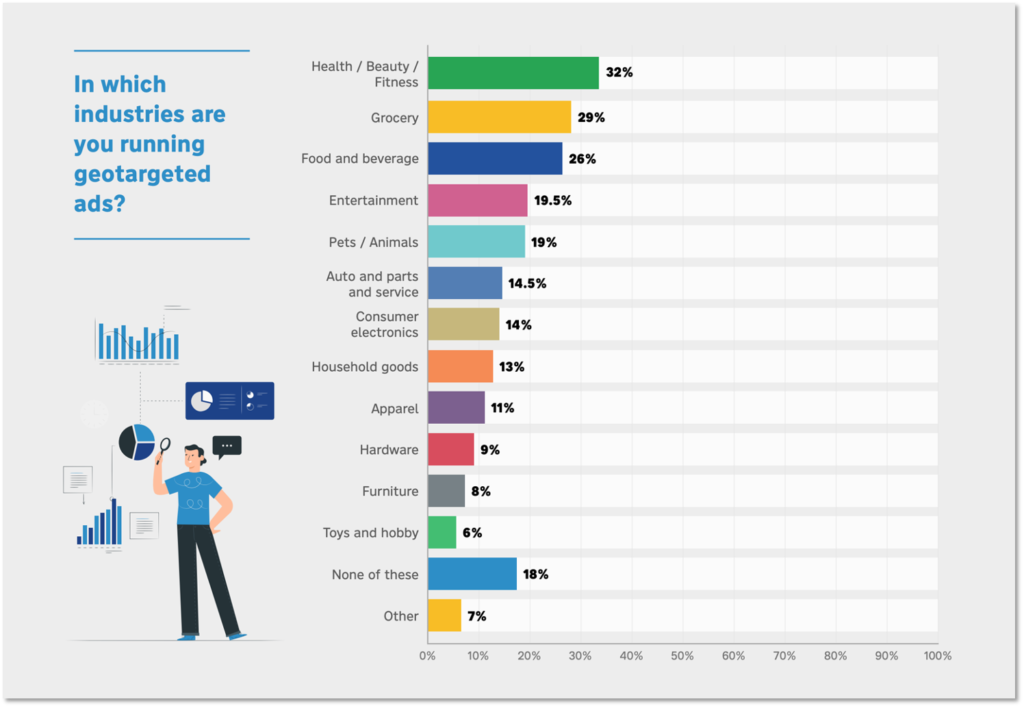

While these figures show where marketers see opportunity, we wanted to know if this is where they are actually making the investment in geofencing.

As it turns out, there’s a direct relationship between where marketers see the greatest potential for location-based ads and where they are spending money. The top five verticals getting the most paid media attention when it comes to geofencing are restaurants and bars, health/beauty/fitness, grocery, entertainment, and pet stores. It’s also worth calling out that 18 percent of ad buyers are not investing in any of the categories we asked about, while another 7 percent are running ads on behalf of CPG / e-commerce and home services.

Geofencing Marketing by Channel

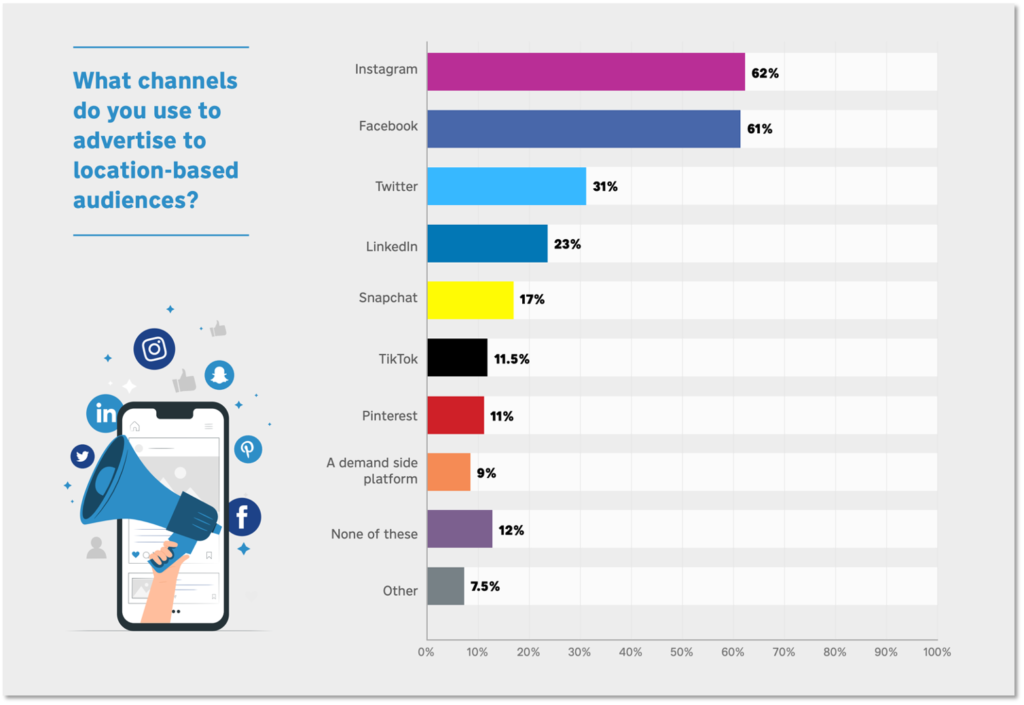

When it comes to channels, B2C marketers rely heavily on Instagram and Facebook. More than 60 percent of all those we surveyed run ads on these platforms. This may come as no surprise. Facebook has proven to be a highly effective channel for getting shoppers to consider, decide and purchase. A distant third place is held by Twitter. LinkedIn and Snapchat round out the top five spots. TikTok and Pinterest are very nearly tied, each of them seeing a little more than 10 percent of mindshare among marketers.

Learn how one digital marketing agency used location-based audiences from VISIT Local to achieve a click-through rate of 246% above average.

Interestingly, just 9 percent of marketers surveyed use a demand-side platform (DSP) to run location-based marketing campaigns, signaling just how much control marketers want to have in terms of audience building, activation, and attribution. All of the social media ad platforms we asked about accept mobile ad IDs for the purpose of audience building, giving marketers full flexibility in terms of targeting, creative, testing, and budget throttling.

Drive store traffic with Facebook, Instagram, and TikTok… Find out how.

Geofencing Marketing KPIs

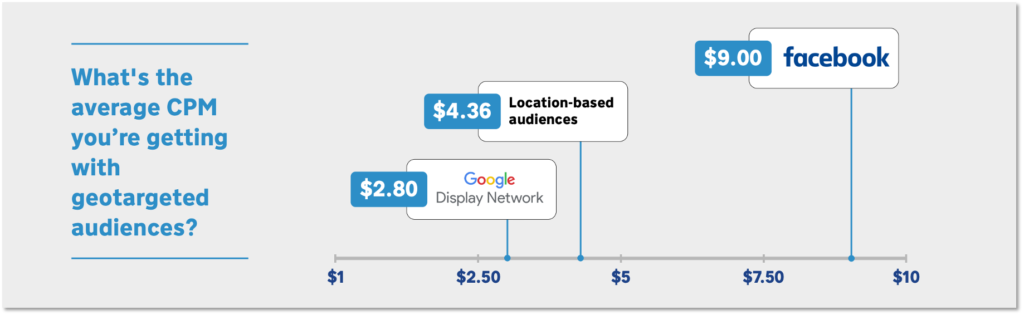

When marketers spend in these channels they see a range of costs and returns related to their investments. Sometimes, cost per impression (CPM) can be slightly higher with location-based audiences because they are higher intent and further into their decision process. Having shown up in a store indicates a propensity to purchase. The average CPM for location-based audiences reported by those surveyed is $4.36, markedly lower than the average CPM of $9 for Facebook ads focused on impressions.

Among the lowest CPMs in advertising can be found on the Google Display Network, which includes Gmail, YouTube, and other sites, averaging $2.80. The downside to Google is that it doesn’t allow for highly targeted location-based audiences, forcing advertisers to rely on its own built-in tools for geotargeting, allowing marketers to focus mostly on countries and/or cities. When marketers want to get the best possible return on investment, they can do so with audiences who have visited specific locations, powered by geofencing technology.

When it comes to cost per click (CPC) and geofenced audiences, this is where digital marketers generally see higher levels of investment. While the average CPC for Facebook ads is $1.68 across all industries, the average CPC for location-based audiences is $5.40. Because these audiences are high-intent and convert at higher rates than more general audiences, the investment can be justified.

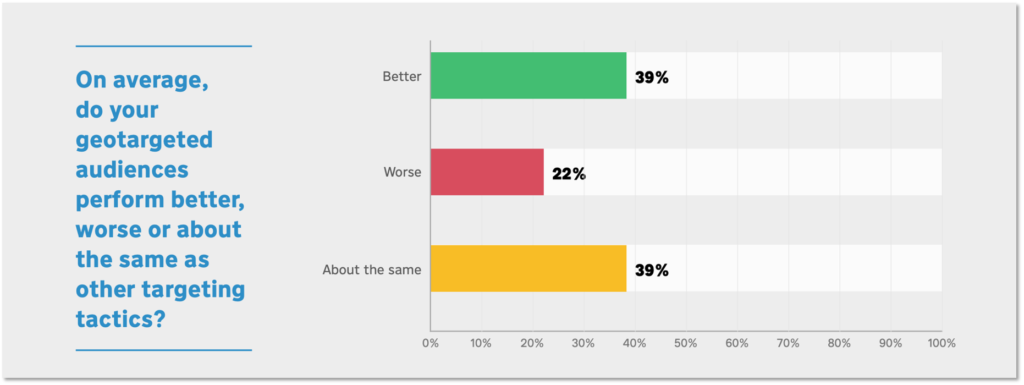

We asked marketers if they think the geofenced audiences they use perform better, worse, or about the same as other targeting tactics. With the data supporting their instincts, 39 percent said they perform better, and 22 percent thought they performed worse. Another 39 percent said they think their location-based audiences perform about the same as other audiences they address.

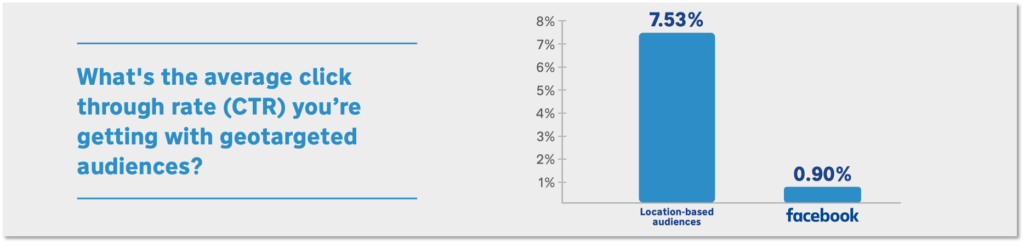

What does the actual performance data say? The average click-through rate (CTR) for geofenced audiences is 7.5 percent. By comparison, the average CTR for Facebook ads across all industries is 0.9 percent. In those industries where marketers invest most heavily in geofencing, the average CTR for general, non-geotargeted audiences is 1.5 percent in retail, 1.2 percent in beauty, and 1.0 percent in fitness. The positive difference with location-based audiences is paramount.

Geofencing Marketing Calls-to-Action

Not all geofencing marketing effectiveness results from the audience. Creative, offer, and call-to-action are all-powerful elements in compelling shoppers to action. While the combinations of these elements are infinite, we wanted to know the most effective CTA used in location-based marketing.

Other effective CTAs by digital marketers use for geofencing marketing include:

- Order now

- Click to save

- Call now

- Shop online

Geofencing Marketing by Campaign Type

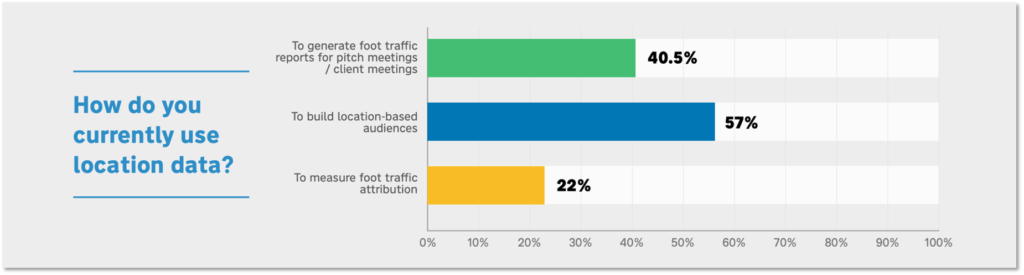

When it comes to use cases for geofencing marketing, there are as many options as there are campaigns. To better understand the range of use cases, we asked digital marketers about the overarching goals of their efforts when it comes to geofencing and geotargeting.

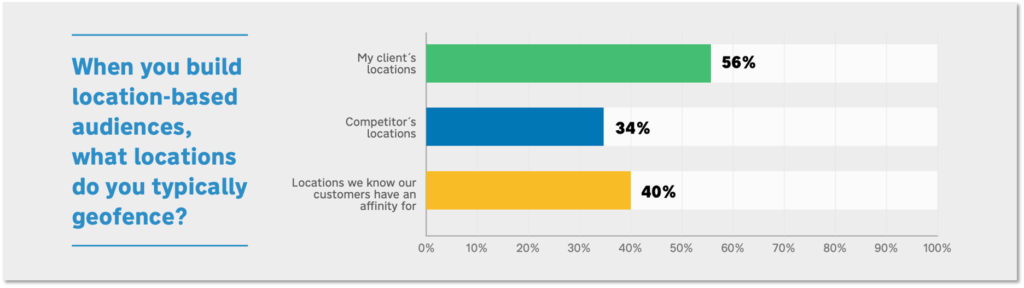

The various uses for location data invited a more specific question about what locations digital marketers geofence. While campaign goals should dictate this aspect of geofencing marketing, there are any number of ways to think about geofencing creatively to generate the best possible results. As it turns out, digital marketers geofence a great variety of places and place types, driven by what they want to achieve in the context of a given campaign.

Geofencing Marketing during COVID-19

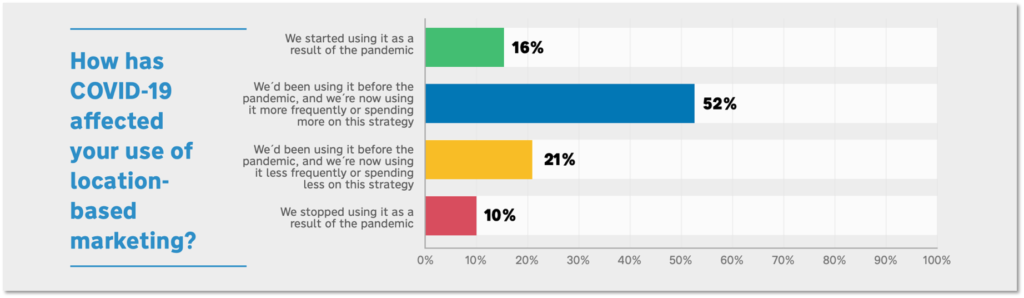

The COVID-19 pandemic was in full swing at the time we sent the survey. We asked digital marketers how the pandemic was affecting their use of geofencing marketing and geotargeting.

More than half of those surveyed have increased their investment in the practice as a result of the pandemic. On top of that, 16 percent of marketers began geofencing marketing as a direct result of the health crisis. Ten percent of digital marketers ceased the practice, likely due to budget cuts and needing to pause advertising in general. The other 21 percent decreased their focus on the practice.

The COVID-19 pandemic emboldened marketers to speed up change, rather than making them more cautious. That means rapid changes in ad spend and campaign execution. Campaign effectiveness takes on greater importance when budgets are stretched.

If you want to easily target the exact people you want to reach, see real-time ad performance and create more agile campaigns, get a demo of the results-driven geofencing marketing platform.